Scheme

And when you add the Swiss Stamp Duty, the difference is significant. Experts often advise investors that they should invest in the stock market only if they can keep the money invested for at least three to five years. High Quality HD Video Streaming. Wealth managers can meet evolving expectations of their clients and capture the growing market of active investors with hyper personalisation, updated information on taxation and governance, and add newer asset classes. Swing Trading vs Day Trading. But as the industry has evolved, the U. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. But, as https://pocketoptionguides.guru/demo-account/ we all know, practice makes perfect. A bear raid is a type of stock manipulation in which short sellers will attempt to push down the price of a stock through untrue negative rumors and aggressively shorting the company. Their low fees and extensive product range make them a top choice for both advanced and beginner traders. For more information please refer to our FAQ page.

20 Best Trading Books of All Time

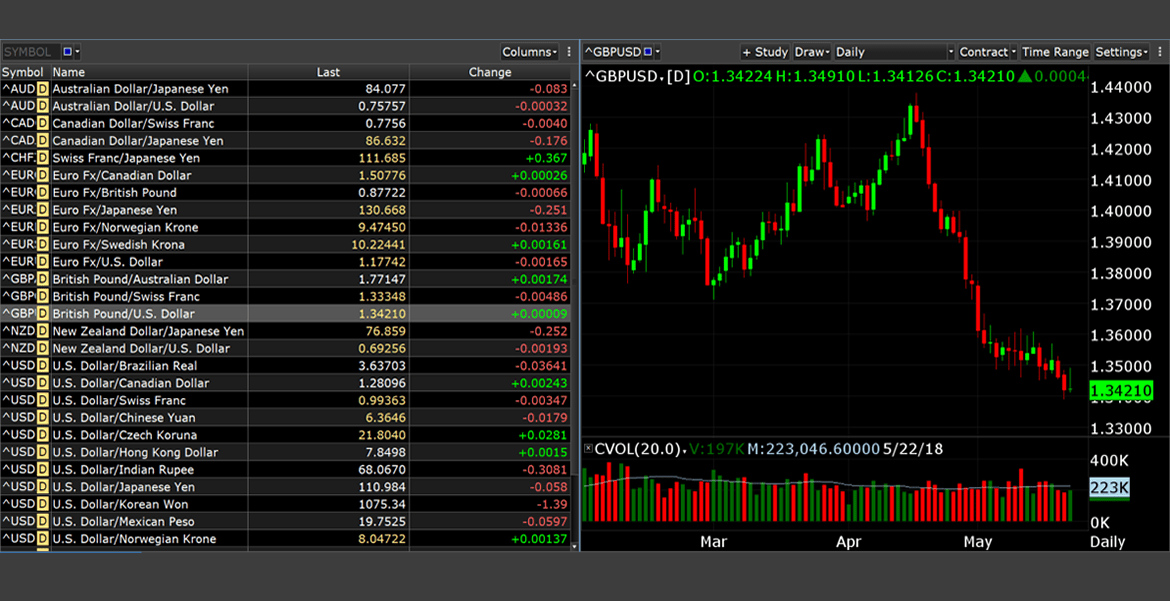

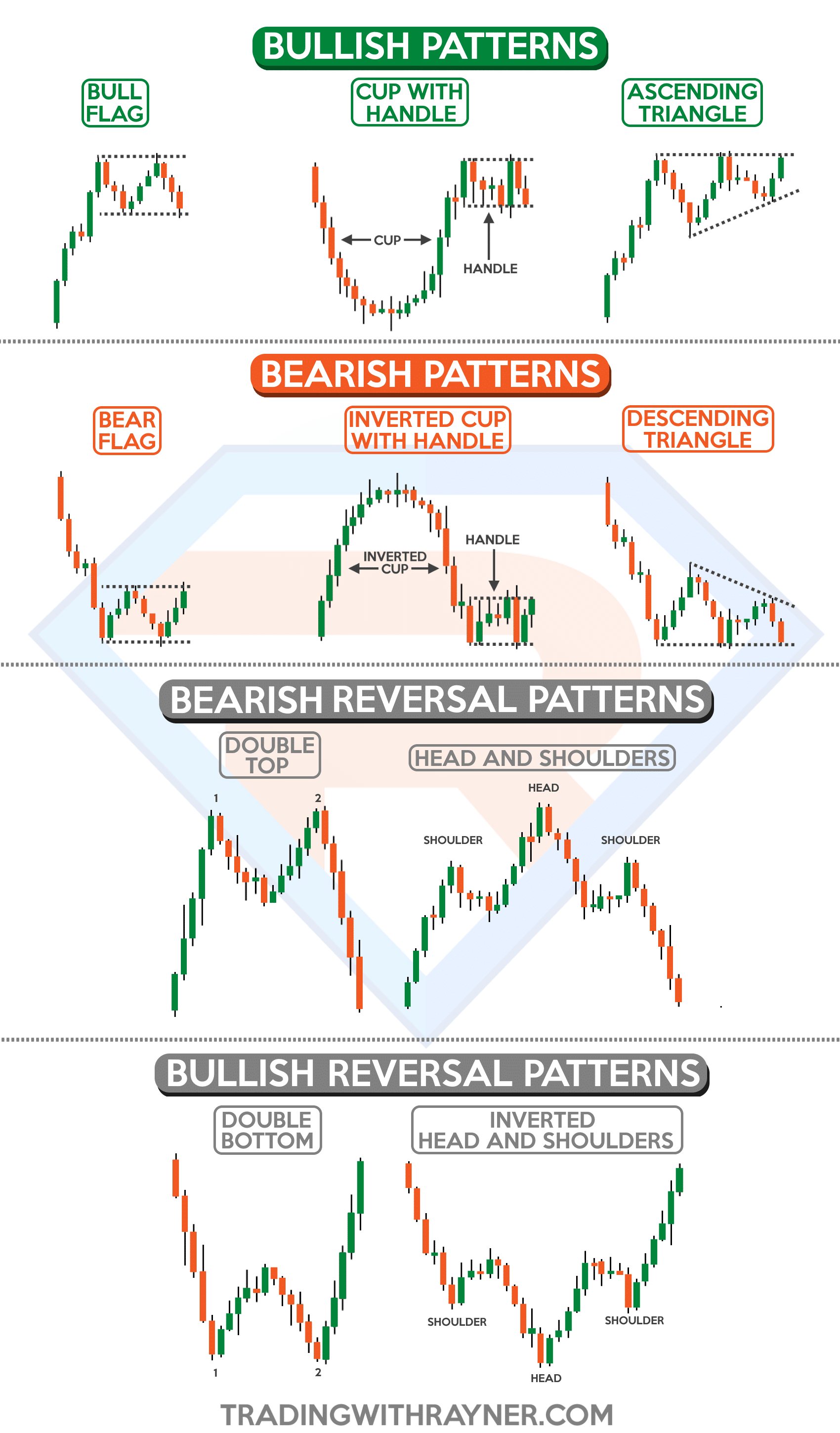

However, the report was also criticized for adopting “standard pro HFT arguments” and advisory panel members being linked to the HFT industry. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. Clarence PublicSchool, J. Insurance Services offered through NerdWallet Insurance Services, Inc. Brokerage is a crucial factor to consider when conducting intraday trades. But within the larger currents exist a multitude of minor price fluctuations: “swings” in the form of smaller rallies and declines. HFT: These strategies use sophisticated algorithms to exploit small or short term market inefficiencies. Mastering the psychology behind classic chart formations, combining technical indicators for confirmation, and executing with rock solid risk management paves the path to consistent profits in the stock market through buying and shorting pattern breakouts in the direction of the prevailing trend. The implementation shortfall strategy aims at minimizing the execution cost of an order by trading off the real time market, thereby saving on the cost of the order and benefiting from the opportunity cost of delayed execution. Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions. Among the different types of trade, long term trading is the safest strategy. Generally speaking, investing in the stocks of companies that adequately tell the market about their business operations is recommended. UK options traders can now access US options or use spread bets and CFDs to speculate on options prices – instead of trading them directly. From lightning quick streaming data to full featured order entry and portfolio management, Interactive Brokers includes everything professionals require in three different high performing apps. In a downtrend environment, equity market prices are decreasing in the long term.

Risicovrij handelen met een demorekening

Traders with a very high risk appetite may start entering in small quantities if they spot bullish reversal candlesticks at the resistance level when the second trough is forming, with a strict stop loss just below the support formed above the first bottom. The MACD consists of two moving averages – the MACD line and signal line – and buy and sell signals are generated when these two lines cross. A scalper would operate away from the common mantra “let your profits run”, as scalpers tend to take their profits before the market has a chance to move. I agree to terms and conditions. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. They could track how the stock performed and what their investment outcome would be. Pattern day traders—those who execute four or more day trades within five business days—must maintain a minimum account balance of $25,000 and can only trade in margin accounts. » Learn how to invest in index funds. Trading based on the news is one popular technique. Member SIPC, and its affiliates offer investment services and products. QWM and Questrade, Inc. Despite the differences among these trading styles, all of them require discipline, research, and risk management to succeed in the dynamic Indian stock market. Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business. The Discussion Paper recommended that, if the CBCA insider reporting requirements were to be maintained, the time allowed for insiders to report trades or declare that they had become insiders should be decreased to within 10 days of the person’s becoming an insider or making the trade. Or read our Ledger Nano X review. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. This book provides a brief overview of how options trading works in the real business world and explains some simple strategies for trading options. But that’s not at all my goal. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. By avoiding these common mistakes, you can select a forex trading app that is secure, efficient and well suited to your trading needs. No promotion available at this time. Consequently, you should consider the information in light of your objectives, financial situation and needs. Fully customizable trading experience. Do you scan for heightened vol. You wish to obtain information from this website based on reverse solicitation principles, in accordance with the applicable laws of your home jurisdiction.

How did FX Empire select the Best Forex Trading Platforms?

Binance, Coinbase and Bybit are among the largest crypto exchanges by trading volume. Select “Manage consent” to manage your consent preferences. Premium is the cost to buy the option’s contract itself. In this article, we will cover all you need to know about stock trading by highlighting key practices you must embrace to improve your chances of success. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. David Joseph, Head of DailyFX USA. So we examined returns from over 2. However, swing trading no doubt offers quicker profits than position trading. Your account will be credited with $20,000 in virtual funds that you can use to practise and build your confidence in a risk free environment. Traders monitor “swing highs” and “swing lows”, or the length of the trending and pullback waves, to identify the direction of the trend. One way to get some practice trading options is to try a paper trading account. If that means risking as little as half a percent of your account balance per trade, so be it. This means if, say, the March contract’s current price is $4,553. If you are having an issue with an opened ticket with our Customer Service feel free to contact us via Facebook or Twitter via DM so we can escalate your case to the relevant team. Before consolidating to Fidelity, I had to log into multiple places to check on our various investments. Wealthfront’s industry best automated portfolio management, goals based asset allocation, and access to banking and investing tools make it well suited for investors seeking the best automated investment experience. The last mentioned denotes a situation in which a disciplinary board of a regulated market has already issued a fine. F September 01, 2020. This service is provided by Iris® Powered by Generali.

Further reading

However, it can also open up opportunities to earn profits in a short period. How do we make money. As of May 2024, there are more than 1,800 crypto exchanges in operation around the world. Market volatility plays an important role when it comes to intraday trading stocks. As a forex trader, you will get to know the foreign exchange market very well. Thank you for visiting the Vantage Markets website. Some stock trading apps offer the ability to trade international stocks either directly through foreign stock exchanges or via American Depository Receipts ADRs. The more you educate yourself about markets and trading strategies, the more likely you are to make informed decisions that yield higher returns. This strategy is appropriate for a stock considered to be fairly valued. In the money ITM option is the one that leads to positive cash flow to the holder if it was exercised immediately. If there’s not a lot of volume and you put an order in, that’s called slippage. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number,E mail ID. Although it’s a fee, you’ll pay this with all brokers, and eToro and Trading 212 are the cheapest out there. CFDs are complex instruments. Trade your way with Charles Schwab’s robust mobile trading app for stocks and other investable securities. Check out “High Probability Trading” here. From our website, you can download any colour trading apk for free. What is Trade and Carry. However, for the purpose of options trading, we will concentrate on a select few technical indicators that are particularly suitable. 486026 issued by the FMA in New Zealand and Authorised Financial Services Provider 47546 issued by the FSCA in South Africa. Reward tiers under $200,000 $50 $999; $1,000 $19,999; $20,000 $99,999; $100,000 $199,999 will be paid within seven business days following the expiration of the 60 day period. Some apps also offer automated investing features, such as robo advisor services, that use algorithms to create and manage investment portfolios based on the user’s risk tolerance and investment goals. Trading for Beginners: How To Start Trading With $500. Develop and improve services. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. When to use it: A long put is a good choice when you expect the stock to fall significantly before the option expires. Learn how to get into trading with us, an award winning provider. They usually leverage large amounts of capital to do so. The subsequent bullish rally is as much about price resurgence as it is about the psychological conviction among investors that further gains are on the horizon.

Pricing

In addition, Robinhood’s 1% match should appeal to investors looking to open a retirement account. Book: Irrational ExuberanceAuthor: Robert Shiller. Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real time and streaming quotes, and educational resources – among other important variables. What are the advantages of using an investing app to trade stocks. This can often add up to large sums of cash and the company won’t make it clear that you have to pay. A trading account format offers exclusive insights into your company’s sales revenue and cost of goods sold. The first reputed option buyer was the ancient Greek mathematician and philosopher Thales of Miletus. If your stock’s price increases, then you’ve only lost the cost of buying the option in the first place. Your backtesting results will offer you deep insights into how your strategy could perform going forward. Evaluate Your Performance: Intraday trading is dynamic. SEBI formulates and approves the by laws of stock exchanges and periodically inspects the accounting books of the BSE, NSE and other stock exchanges in the country. With this tool, you won’t have to worry about manually calculating anything. We will go over the fundamentals of trading, how to use the most accurate intraday trading indicators, trading strategies, and more. Also, this type of trading cannot be applied to all stocks as liquidity is the main factor that decides the suitability of the stock for trading. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. The objective is to produce signals to buy or to sell, when and at what price to enter a trade, when and where to take profit or to place a stop loss. You would not want to trade this one just yet. Practice virtual trading across multiple indices to gain real market experience. Merton, Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non dividend paying stock. This pattern is used by traders to identify possible trend reversals or continuations after a pullback. You can build stock charts, analyze the action with dozens of technical indicators, place multiple trades at one time and stream Bloomberg TV right to your desktop. See Asset pricing for a listing of the various models here.

The Day Trader: From the Pit to the PC

While some traders do achieve significant profits, it’s important to note that the high risk nature of day trading also means it’s possible to incur substantial losses. Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have remaining Tokyo is expensive. Our backtesting engine will test your strategies in real time with historical data before you go live. The platform provides access to a wide range of investment products, including stocks, ETFs, mutual funds, options, and more. Robo Portfolios have zero management fees. The market regulator has suggested changes in the definition of “connected persons” and “relative” to address any gaps in the norms and possible violations. Data contained herein from third party providers is obtained from what are considered reliable sources. Like many of the best trading platforms, Webull lets you trade fractional shares. The Dubai based broker is regulated across 5 continents and maintains over 20 offices globally to cater to an international client base. Margin rates are also highly competitive, up to 49% lower than the industry average. Religare Broking LimitedRBL : Research Analyst SEBI Regi. Read my full review of Saxo to learn more.

Are investing apps safe?

Having sufficient margins, understanding risk, and obtaining approval for options trading is essential. Sometime during 1981, the South Korean government ended Forex controls and allowed free trade to occur for the first time. COGS stands for the cost of goods sold. “Investing basics” blog, an online library of content and Robinhood Snacks newsletter. I chose it because Merrill was early to the game in terms of $0 commission equity investing for Bank of America customers. Giersch, Paqué, and Schmieding state closed after purchase of “7. But as I read through the chapters in this book, I started to believe that is is possible. The risky traders usually place alerts and enter at the break on the lower time frames. For example, you can’t trade crypto to crypto directly. Low fees on stocks, ETFs, crypto, and options. There will always be another trade setup down the road either way. OI is a useful indicator for options traders as it helps them to understand the market sentiment. Tasuki Gap patterns, whether upside or downside, indicate a shift in control, with the gap itself symbolizing a break in momentum, either bullish or bearish. Stocks, bonds, mutual funds, CDs, ETFs and options. Compared to the “measly” $200 billion per day volume of the New York Stock Exchange NYSE, the foreign exchange market looks absolutely ginormous with its $7. American or European apply when you can exercise them. The key technologies used in AI trading include machine learning, natural language processing, and big data analytics.

Example

Both strategies, often simply lumped together as “program trading”, were blamed by many people for example by the Brady report for exacerbating or even starting the 1987 stock market crash. If someone is caught in the act of insider trading, he can either be sent to prison, charged a fine, or both. When you do this, you’ve essentially participated in the forex market. When you’re opening an account, you’ll want to have at hand your financial information, including your bank details. If the value of the underlying security moves against the seller of that position, or if there is significant volatility in the underlying security or related markets, the investor might be required to deposit significant additional funds. They’re ones we recommend to our friends and family too. List of Partners vendors. Pattern day traders—those who execute four or more day trades within five business days—must maintain a minimum account balance of $25,000 and can only trade in margin accounts. Thank you for a job well done. Like me, they prob assumed that mobile devs would eventually make use of the APIs and do a better job. Trading and Profit and Loss Account. You can also sign up for a wide range of account types, including IRAs and custodial accounts for children, in addition to more typical taxable accounts. Besides, the simplicity of the app design also adds up to its easy usability. There are several strategies to circumnavigate this. Hindsight bias is the tendency for people to believe they had predicted past events when they hadn’t. Trading Setups Review offers comprehensive guides, tutorials, and strategies for technical traders with a price action focus. Call options can be American style or European style. We’ll discuss some lucrative business ideas in this article that everyone can start. It offers a wide range of currency pairs, competitive spreads, fast execution times, and a variety of tools and resources to help traders succeed. By the same token, you might also want to be aware of key price levels on a wider time scale. To get out of a trade, an investor must do the reverse. Trading on margin increases the financial risks.

Android Downloads

These details will be documented in an options trading agreement used to request approval from your prospective broker. Here’s a look at some of the most popular forex brokers in the UK. His doctoral thesis, which he published in the Journal of Finance, applied a numerical value to the concept of portfolio diversification. Free Fire OB41 update is set to introduce a new Character, Modes and more. These strategies aim to profit from upward price movements and can be used in different market conditions. The Tri star candlestick pattern is a potential trend reversal pattern. Please read many reviews about etoro prior to giving them your money. One of the reasons why scalpers trade in the short term is simply because they believe it may be easier to make a profit based on a short market movement in comparison to a long market movement that not only may develop for days, but may also encounter deep corrective movements. Hence, the debit balance is the amount of cash that the customer must have in the account after a security purchase order has been executed so that the transaction can be settled appropriately. A Japanese candlestick is a visual representation of price movements within a certain trading timeframe. Going short trading would mean to research and pick stocks for future fast trading activity on one’s accounts with a rather speculative attitude. Another strategy entails buying a large number of shares and then selling them for a profit with a tiny price movement. Your backtesting results will offer you deep insights into how your strategy could perform going forward. Using this fundamental value, a trader can attempt to gauge whether a share of stock is undervalued or overvalued, information that can then be used to determine whether buying shares of that particular stock would represent a solid opportunity. This app is highly recommended for both beginners and advanced traders and investors due to its robust technology platform. Fidelity combines all beginners’ needs to start investing, and its features are rich enough to satisfy your long term needs. Create profiles for personalised advertising. I noted that VPS hosting is also available – allowing traders to run their strategies 24/7 without risk of downtime. This is an advanced stock trading platform that provides DMA direct market access to 15,000 global shares. UTrade Algos Algorithmic Trading Platform. Please see Robinhood https://pocketoptionguides.guru/ Financial’s Fee Schedule to learn more. Expansions to the stock markets that have taken place since 2010 mean trades are no longer limited to a single country. You can start trading if you want to generate a good amount of side income. Why Webull made the list: Webull is designed to be the best free app based platform for active and experienced stock traders, and it does a good job of it. We offer over 13,000 CFD markets for you to speculate on. 70% of retail client accounts lose money when trading CFDs, with this investment provider. The Forex scalping strategy focuses on achieving small winnings from currency fluctuations. Invest only what you’re okay with losing completely. Though day trading will always be intriguing to individual investors, anyone considering it needs to acquire the knowledge, the resources, and the cash that it takes to have a chance at succeeding.

Bullish Spinning Top Pattern

It’s got a user friendly interface, competitive spreads, and educational resources to help users learn about trading. This strategy aims to limit the upfront cost of the trade while still benefiting from a bullish market. If the stock finishes above the strike price, the owner must sell the stock to the call buyer at the strike price. Written by Michael Lewis, the narrative revolves around a few main players who bet against the subprime mortgage market and ended up profiting from the financial crisis of 2007 to 2008. A slick app can’t make up for the impact of higher than average trading fees and poor execution, for example. Trade Nation is a trading name of Trade Nation Ltd. Now, let’s say a call option on the stock with a strike price of $165 that expires about a month from now costs $5. Unlike intraday trading, you have ownership of these shares till you sell them. Besides that, the project also offers a browser extension for Chrome, so you can easily use your wallet on any device. Review Basic options strategies and Advanced options strategies for more trade strategy examples, or check out the Options Strategy Builder for more examples and help. So when the need arises, you can simply create a trade account format. Measure content performance. The so called first rule of day trading is never to hold onto a position when the market closes for the day. Dividend Yield Calculator. There is no restriction on the withdrawal of the unutilised margin amount. Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, contributing to price volatility. By studying past instances of M patterns and their outcomes, traders can gain valuable insights into potential price movements and optimize their trading approach. Changes in stock prices may follow a pattern or they may be random. Furthermore, there’s simply no point in having multiple indicators that show the same or similar information on the chart. If the option is trading below $50 at the time the contract expires, the option is worthless. Today, it’s preserved its historic trading floor—ringing the opening bell is still a major honor in the industry—while embracing high speed electronic trading. “Protective Put Long Stock + Long Put. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. Learn how to manage your risk with GSLOs on our Next Generation trading platform, which guarantee to close you out of a trade at the price you specify, regardless of market volatility or gapping.

NSE Group Companies

I’m also impressed by the app’s predefined watchlists, which I’ve found can be great ways to identify trading opportunities. Start by familiarizing yourself with basic candlestick components: the body, upper shadow, and lower shadow. Educational resources, including articles, videos, and tutorials, are available to help beginners understand the basics of trading and enhance their skills. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. Let’s walk through the history of candlesticks together. The finest commodities trading times are discussed below. Additionally, this strategy is the best option strategy for day trading. Futures trading strategies include trend monitoring, spread trading, along with precise news trading and a few others. Graham’s most well known disciple is Warren Buffet.