PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Bloomerang is the community-focused nonprofit donor management software built to deliver a better giving experience and help organizations thrive. We understand the importance of accurate fund management in your mission-driven work. That’s why we’re excited to offer you a unique opportunity to see FastFund in action. Experience firsthand how our solution can transform your accounting tasks and free you from the constraints of inadequate tools.

- Unlike temporarily restricted funds, these do not necessarily have a time constraint but must be used exclusively for the intended purpose.

- For instance, a donor might contribute to a nonprofit with the stipulation that the money be used for a particular project, such as building a new community center, and within a set timeframe, like two years.

- Nonprofits must include a balance sheet when applying for federal tax exemption and filing taxes.

Are non-profits required to track interest earned on restricted funds separately, and how is it accounted for?

During an audit, both restricted and unrestricted funds must be examined to verify that they are being used in accordance with donor restrictions and organizational goals. This involves regular reconciliation of accounts to verify that expenditures align with donor restrictions. For instance, if a donation is earmarked for a specific program, all related expenses must be meticulously tracked and reported. Tools like Sage Intacct can facilitate this by providing real-time financial insights and customizable reporting features. These tools help organizations maintain transparency and accountability, which are crucial for donor relations and compliance with legal requirements. Purpose-restricted funds are allocated for specific projects or initiatives as defined by the donor.

Accounting for Donor Restrictions

Sharing how your nonprofit’s financial status has changed gives board members, donors, and foundations a better overview of the health of your nonprofit. If your organization uses cash-based accounting, nonprofit balance sheets may not provide an accurate snapshot. In another example, a grantmaker might restrict funds so they must be used during a specific time period. When that time period is over, the nonprofit might be required to give the leftover funds back to the funder.

Best Donor Appreciation Gifts: The Art of Gratitude

The primary types of restricted funds include temporarily restricted funds, permanently restricted funds, and purpose-restricted funds. Misuse of restricted funds can lead to legal consequences, loss of donor trust, potential financial penalties, and damage to the organization’s reputation. Once the donor’s intentions are clear, the next step is to integrate these restrictions into the organization’s overall financial strategy. restricted funds on balance sheet This often involves creating detailed project plans that outline how the restricted funds will be used, monitored, and reported. These plans should be flexible enough to adapt to any unforeseen changes while still adhering to the donor’s original intent. Utilizing project management tools like Asana or Trello can help keep these plans on track and ensure that all team members are aware of their responsibilities.

For example, a donor might give money specifically for purchasing medical equipment for a nonprofit hospital. Accurate accounting and clear communication with donors are vital to ensure that the funds are used appropriately and that the organization remains accountable. Non-profit organizations navigate the delicate balance between honoring donor intent and managing resources effectively. Effective donor relations and stewardship are paramount in maintaining donor trust and ensuring the proper allocation of both restricted and unrestricted funds. When it comes to financial reporting, nonprofits must adhere to best practices to ensure clarity and precision in how funds are reported.

Methods for Tracking and Reporting

There may also be special reporting or tax requirements based on the type of gift and the specific restrictions placed by the donor. Review and understand these aspects carefully before you begin using the funds. Lenders sometimes require a company to hold restricted cash as partial collateral against a loan or line of credit. This is a fairly common practice in situations in which a bank grants a business loan to the owner of a new small business.

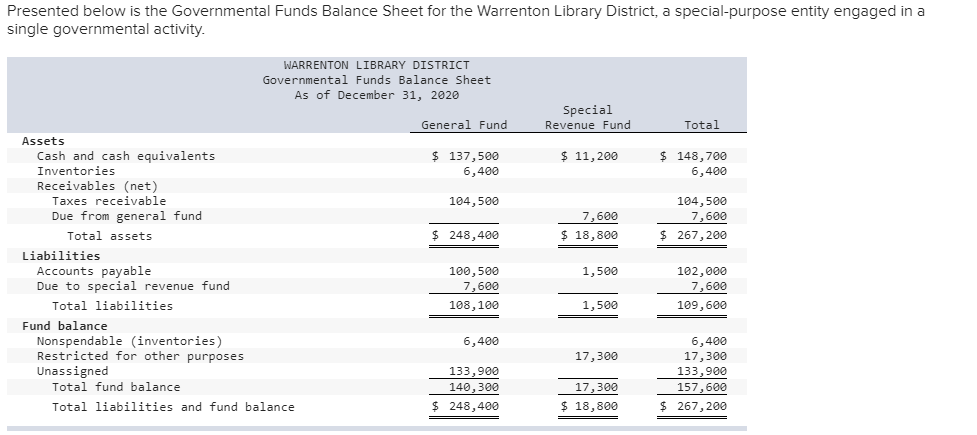

In many ways, fund balance represents working capital, which can either be used as a liquidity reserve or for spending in future years. Most nonprofits also have procedures that they apply to demarcate funds during the budget, and also assigning program codes to each restricted fund. Disbursements, expenses records, and other records will then be tied to the specific program code of each fund, making tracking easier. The primary, and possibly most important reason, for complying with requirements for restricted funds is trust.

Additional policies may need to be adopted or revised to be consistent with the new definitions. This approach is intended to provide users more consistent and understandable information about a fund’s net resources. As the name suggests, restricted funds are gifts or donations that carry specific obligations or instructions relating to the use of the funds. The instruction may be to the extent that the fund can only be exhausted in a certain way or that it must be used on a specific project. In either case, when a donor specifies how they want the funds to be used, then the funds are restricted. For example, stipulations can restrict funds to investment principle or income.

This article shares what you should include in a nonprofit balance sheet and provides a sample of how to write your own. Understanding how to manage these funds is essential for maintaining financial integrity and transparency within an organization. Due to the cash not being readily available for use, cash that is restricted is generally excluded in several liquidity ratios.

Donors can also designate that a gift be used for a purpose they choose, completely independent of any fundraising campaign. As a result, nonprofits that care about showing accountability and trustworthiness will need to ensure the appropriate accounting standards are followed. The key to success lies in meticulous tracking, strategic planning, and clear communication, all of which are facilitated by adopting the right tools and practices. Nonprofits often rely on a variety of funding sources to sustain their operations and achieve their missions.

As a nonprofit professional she has specialized in fundraising, marketing, event planning, volunteer management, and board development. You’ll also need to have a balance sheet and a snapshot of your organization’s finances at the beginning and end of the year when filing IRS tax form 990. Balance sheets are also an excellent way to track how your organization’s financial status has changed in past years. John, a junior analyst, has been instructed by the head of equity research to conduct liquidity analysis of a company. More specifically, he has been asked to determine the current ratio of a company to see if it has enough cash to pay off its short-term obligations.